Investors

IR Basic Policy

The basic approach of ALPS ALPINE CO., LTD. (the “Company”), placing importance on maximizing benefits for all stakeholders including shareholders and investors, is to maximize corporate value and deliver benefits directly or indirectly to stakeholders in a balanced way, satisfying their respective interests. Based on this approach, the Company puts emphasis on dialogue with shareholders and investors on a regular basis, and discloses information on its financial conditions, business strategies, etc., in a timely, appropriate and fair manner, while also promoting constructive dialogue. Through these ongoing efforts, the Company maintains fairness and transparency in management and strives to continuously create corporate value, build relationships of trust, and maximize shareholder value.

1. Organizational Structure to Conduct IR Activities

The Company has appointed the Director supervising the Administration Division as the officer in charge of investor relations (IR), and established the IR Section of the Corporate Communication Department as a department responsible for planning, managing and performing IR activities. Regarding information disclosure, the Company endeavors to disclose matters resolved by the Board of Directors and its corporate and financial information in a timely and appropriate manner by having the department work closely with the Corporate Planning, Corporate Accounting, Corporate Treasury, Human Resources, Legal Affairs and other relevant departments.

2. Criteria for Information Disclosure

- To maintain fairness and transparency in management, the Company discloses its decisions, facts that have occurred to the Company, information on its financial results, etc., that impact investment decisions, in accordance with the Companies Act, the Financial Instruments and Exchange Act, and other relevant laws and regulations (the “Relevant Laws and Regulations”) and the rules on timely disclosure of corporate information by issuers of listed securities established by the Tokyo Stock Exchange (the “Timely Disclosure Rules”).

- The Company also discloses in a proactive and fair manner, any information which does not fall under the category of the material fact defined under the Relevant Laws and Regulations or the Timely Disclosure Rules, but is considered important to shareholders and investors making investment decisions or understanding the Company.

- In order to prevent the leakage of earnings information, the Company designates "Silent Periods" from the day following the financial closing date to the day of the announcement of the quarterly earnings results. During this period, we do not answer to or make comments on inquiries related to the earnings results.

Reference: Disclosure Information

| Types of Disclosures | Item | Disclosure Documents, etc. |

|---|---|---|

| Statutory Disclosures | Disclosures in accordance with the Financial Instruments and Exchange Act | Securities Reports, Semiannual Reports, Internal Control Reports, Extraordinary Reports, etc. |

| Disclosures in accordance with the Companies Act | Financial Statements, Consolidated Financial Statements, etc. | |

| Disclosures required by the Tokyo Stock Exchange | Timely Disclosures | Disclosures of information about corporate decisions or events for which the TSE requires timely disclosure |

| Other | Corporate Governance Reports | |

| Other Information Disclosures | Disclosure materials related to IR activities, Integrated Reports, etc. |

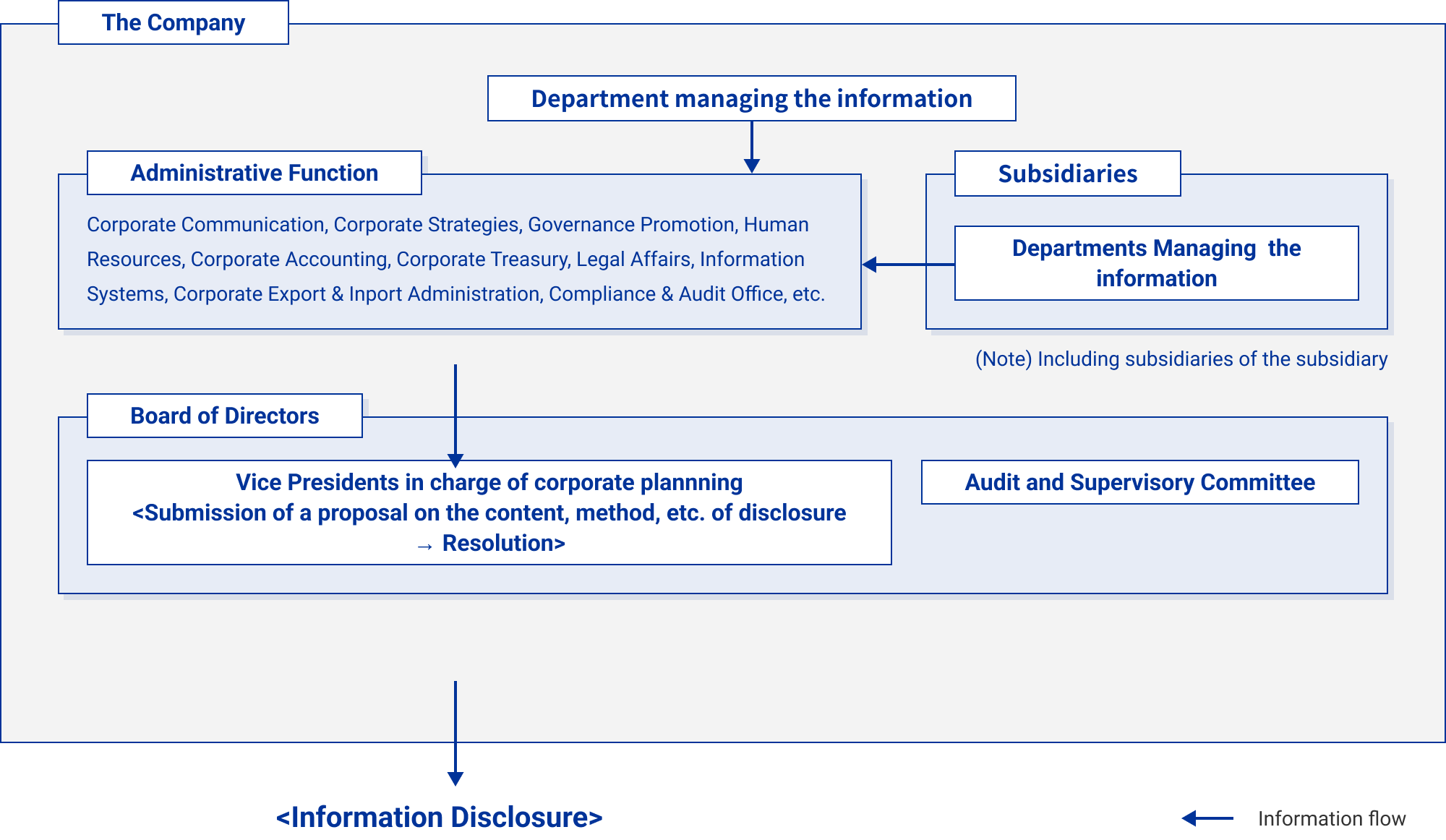

3. Disclosure Process

- For corporate information generated in and out of the Group, each department in the Administrative Function endeavors to collect facts from the department managing the information and shares them in the Administrative Function. The General Manager of Corporate Communication Department discloses information in accordance with laws and regulations and the Timely Disclosure Rules after discussions at the Board of Directors meetings, etc. by Directors and Vice Presidents (or responsible persons). For corporate information on financial results, the Director in charge of management reports the progress and definitive results on a quarterly basis to the Board of Directors, which subsequently resolves such matters.

- Information subject to the Timely Disclosure Rules is disclosed on the Timely Disclosure Network (TDnet) provided by the Tokyo Stock Exchange.

- Securities reports and other reporting documents based on the Financial Instruments and Exchange Act are disclosed on the Electronic Disclosure System (EDINET) provided by the Financial Services Agency.

- The information disclosed in (1) (2) and (3) above will be posted on the Company's website promptly after disclosure.

- Information other than (1) (2)and (3) above that may affect investment decisions will be promptly disclosed as appropriate through the distribution of press releases, press conferences, briefings, etc.

- In addition, we will enhance opportunities for direct dialogue by holding financial results briefings for analysts, institutional investors, and the media every quarter, as well as regular visits by directors and other members of the Board of Directors to domestic and overseas investors. In addition, we will publish a shareholder newsletter (Alps Alpine Report) to introduce new products and technologies in addition to business reports, in an effort to deepen understanding of our business. We will continue to disseminate information on management strategies and issues, risks and governance, as well as non-financial information such as new product information and the latest news on business activities, through our website and integrated reports.

Reference: In-house Structure for Timely Disclosure

4. Dialogue with Shareholders and Investors

The Company regards constructive dialogue with shareholders and investors, as an important opportunity that contributes to sustainable growth and medium- to long-term improvement of the corporate value of the Company.

- The Representative Director and President, Directors in charge of management, and others, engage in continuing dialogues by attending results and business briefings, management meetings with investors in Japan and abroad, and so forth, and making an explanation there.

- In regards to dialogue with shareholders and investors (IR meetings), taking into consideration with whom they want to talk and what are their main topics they want to talk about in the meeting, the Company selects appropriate attendees at the meeting, including Outside Directors, while the Corporate Communication Department acts as the contact point.

- As a means of dialogues other than individual meetings, a results briefing is held for analysts, institutional investors and the press after the announcement of results on a quarterly basis. In addition, opportunities for conversation with institutional investors are provided, including company information sessions utilizing conferences hosted by securities companies in Japan and abroad.

- Information obtained through the dialogue is compiled by the Corporate Communication Department, the contact point for the dialogue, and reported to the management and relevant departments through Management Meetings such as the Board of Directors meetings.

- Major activities

Activity Description General Meeting of Shareholders Holding the Ordinary General Meeting of Shareholders once a year and an Extraordinary General Meeting of Shareholders as necessary Briefing on earnings announcement Holding a briefing quarterly IR Day Holding a briefing on the Company’s medium-term management plan, strategies by business segment, progress on the plan and strategies, etc. Individual meetings

for institutional investors and analystsHolding IR meetings with investors in Japan and abroad and analysts of securities companies Individual meetings for shareholders Holding shareholders relations (SR) meetings with shareholders to build relationships with shareholders Conferences hosted by securities companies Holding a series of individual meetings mainly with institutional investors abroad at conferences in Japan and abroad IR information disclosure The Company’s bulletin for shareholders (ALPS ALPINE REPORT), Securities Report, integrated report, website (information for shareholders and investors), etc.

5. Spokesperson for IR activities

In order to ensure the accuracy of information and the fairness of disclosure, the spokespersons for the Company investor relations activities shall, in principle, be Representative Director and President, Representative Director and Executive Vice President, Director in charge, Executive Officer in charge, and members of the Investor Relations Sector. In addition, directors, including outside directors, corporate auditors, and employees may be responsible for acting as spokespersons as the need arises.

6. Management of Material Information

- Scope of Material Information

In accordance with laws and regulations, the Company considers information subject to insider trading regulations (insider information) and definitive financial information prior to public disclosure as " Material Information" that has a significant impact on investors' investment decisions. - Management of Material Information

In order to disclose information to all market participants in a fair and appropriate manner, the Company makes efforts to ensure that insider information is properly managed, including fair dialogues (IR meetings) with shareholders and investors, and strives to prevent internal and external leakage of information in accordance with the rules for restrictions on insider trading. In disclosing information, the Company observes the Financial Instruments and Exchange Act and other relevant laws and regulations as well as the rules that must be observed in performing the duties, and strives to prevent internal and external leakage of information.