Alps Alpine at a Glance

Here is some information to help you

better understand Alps Alpine.

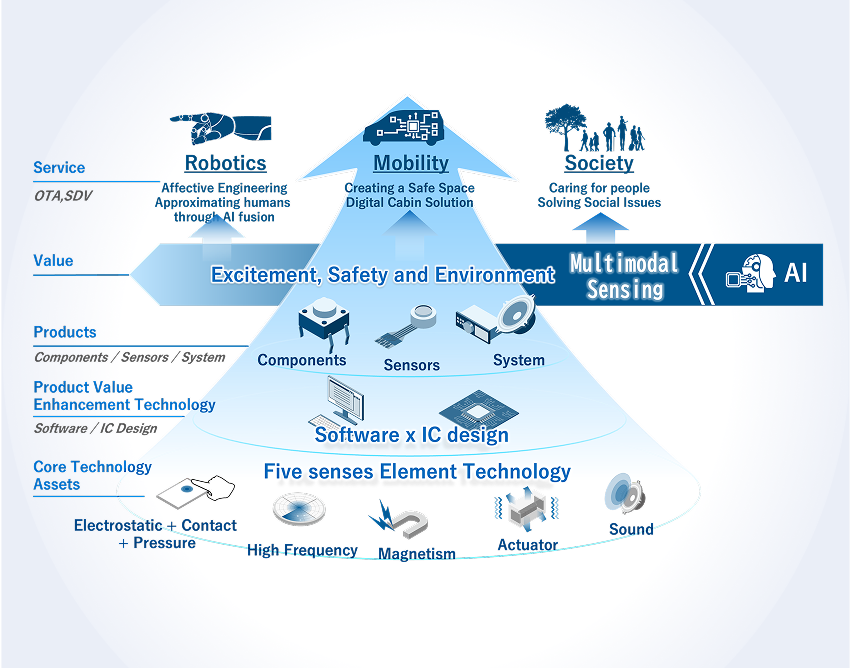

We are a manufacturer of electronic components and in-vehicle information systems.

Alps Alpine innovates value

for humans and society on a

brighter planet.

Shaping a future where technology

extends your senses

Since our founding, we have created many First 1 (world's first, and Japan's first)

providing surprises and excitement.

TV tuner

1954

VHF tuner released the year after the start of TV broadcasting

Car Navigation System

1981

Jointly developed “Gyrocator” with Honda Motor Co., Ltd *1

PC Mouse

1983

Japan's first mouse developed at the request of Microsoft

Beam shaping lens for optical communication

1995

Lenses for Optical Communication Contributed to the Spread of the Internet

Aerial Display/Input Device

2022

Jointly developed Stealth Aerial Interface with Utsunomiya University

TACT Switch™

2024

The world's smallest*2 TACT Switch™ that contributes to the miniaturization of electronic devices

- *1 Gyrocator is a registered trademark of Honda Motor Co., Ltd.

- *2 As of October 2024, according to our research

Gaming, VR/XR, Communications, Printers, Environment, Automotive...

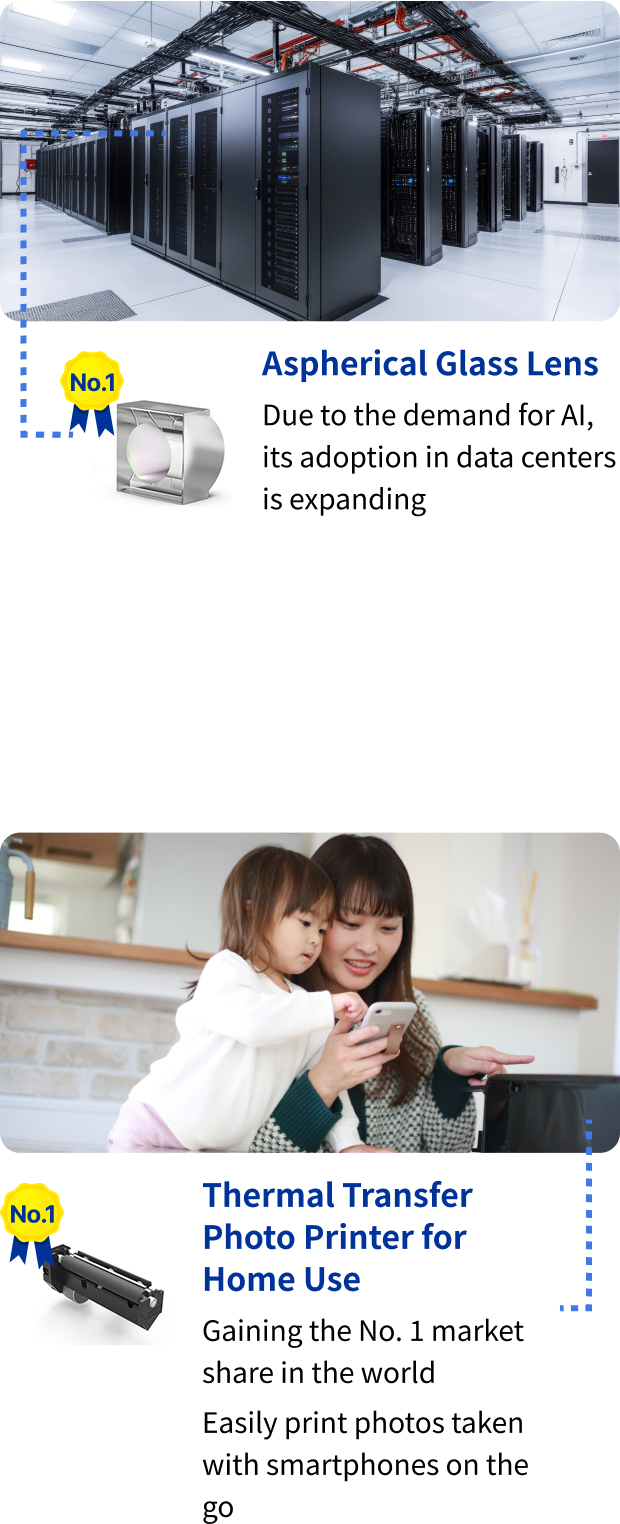

We gained the top share in a variety of markets. *2024, according to our research

Game

Consumer

Automotive

Have Diverse aspects

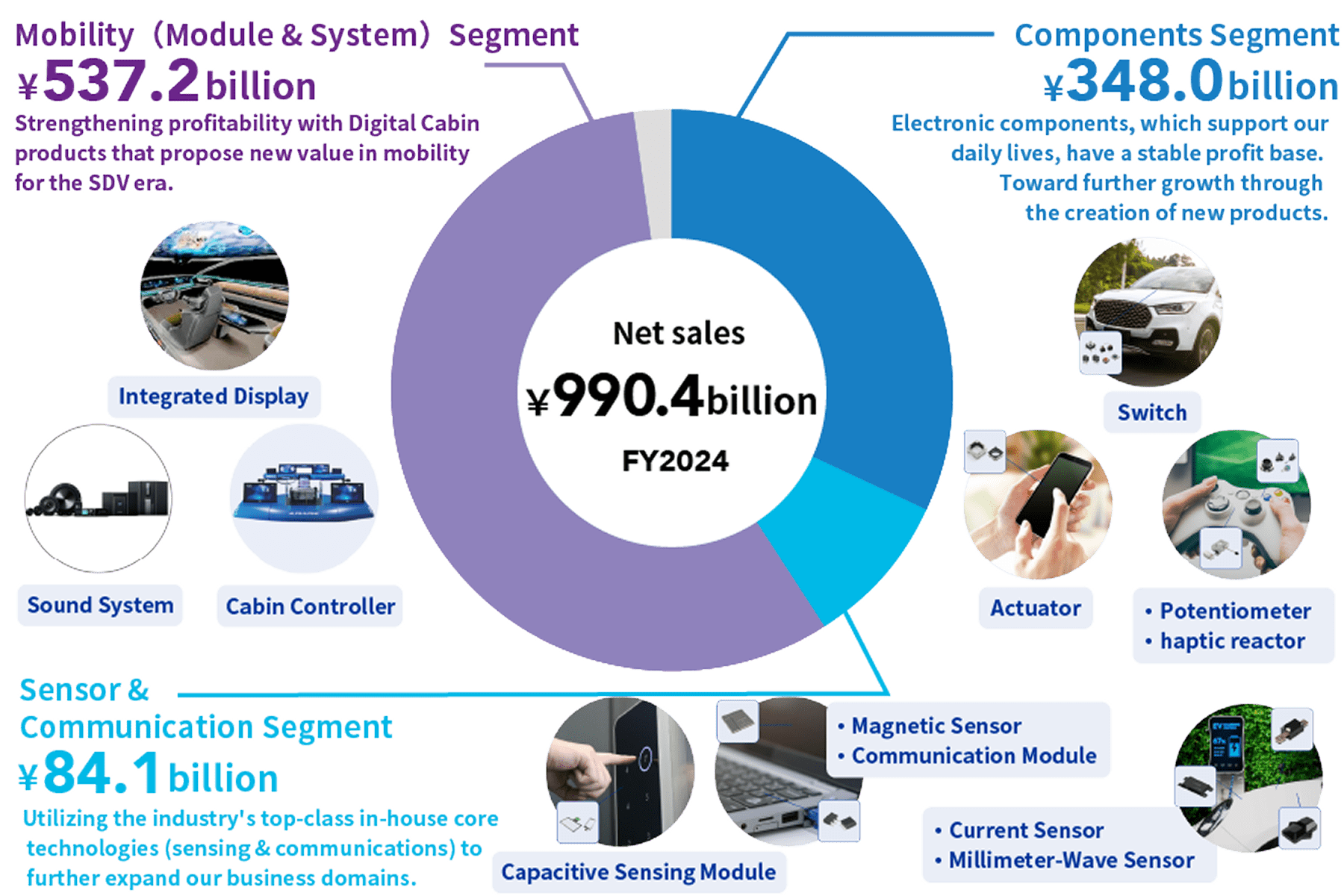

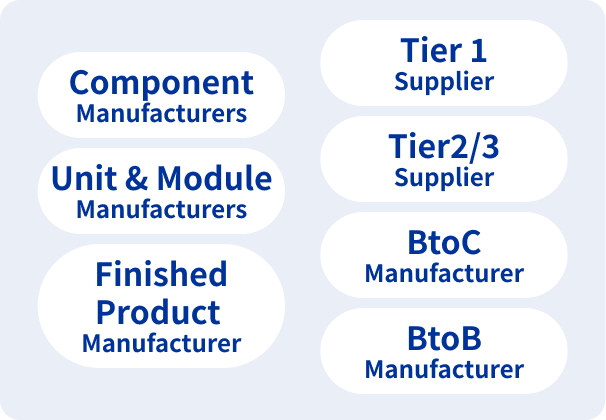

We can provide a full range of services, from electronic components to devices and solutions. Our ability to respond to diverse needs contributes to the expansion of our business.

Have a pillar of

earning stable profits

For electronic components such as tact switch ™ and encoder, we have achieved stable and high profits through advanced production technology that enables in-house production of facilities and molds.

Have hardware and

software development

capabilities

We aim to increase profitability with high-value-added products such as Digital Cabin that integrate software and electronic components to create an impressive mobility space.

Have strong connections

with leadingCar

manufacturers

In the automotive industry, where barriers to entry are high, we have built long-standing relationships with major Car manufacturers with our brand and technological capabilities. We are a partner that co-creates from planning and design.

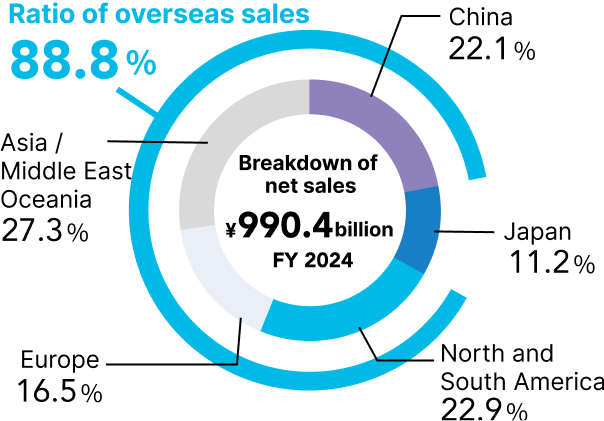

Earn in balance around

the world

Well-balanced that does not depend on the market environment of one region. In addition, by designing and producing products in the customer's region, we can quickly grasp changes in demand and increase our competitiveness.

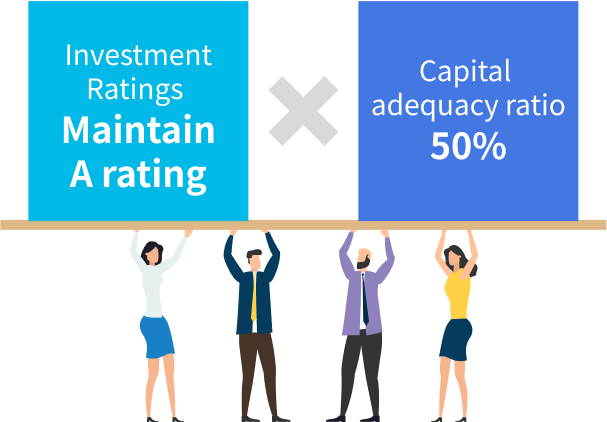

Have a sound

financial base

Our customers, automakers, choose suppliers that can provide a stable supply even after 10 years. Sound finances underpin our trust.

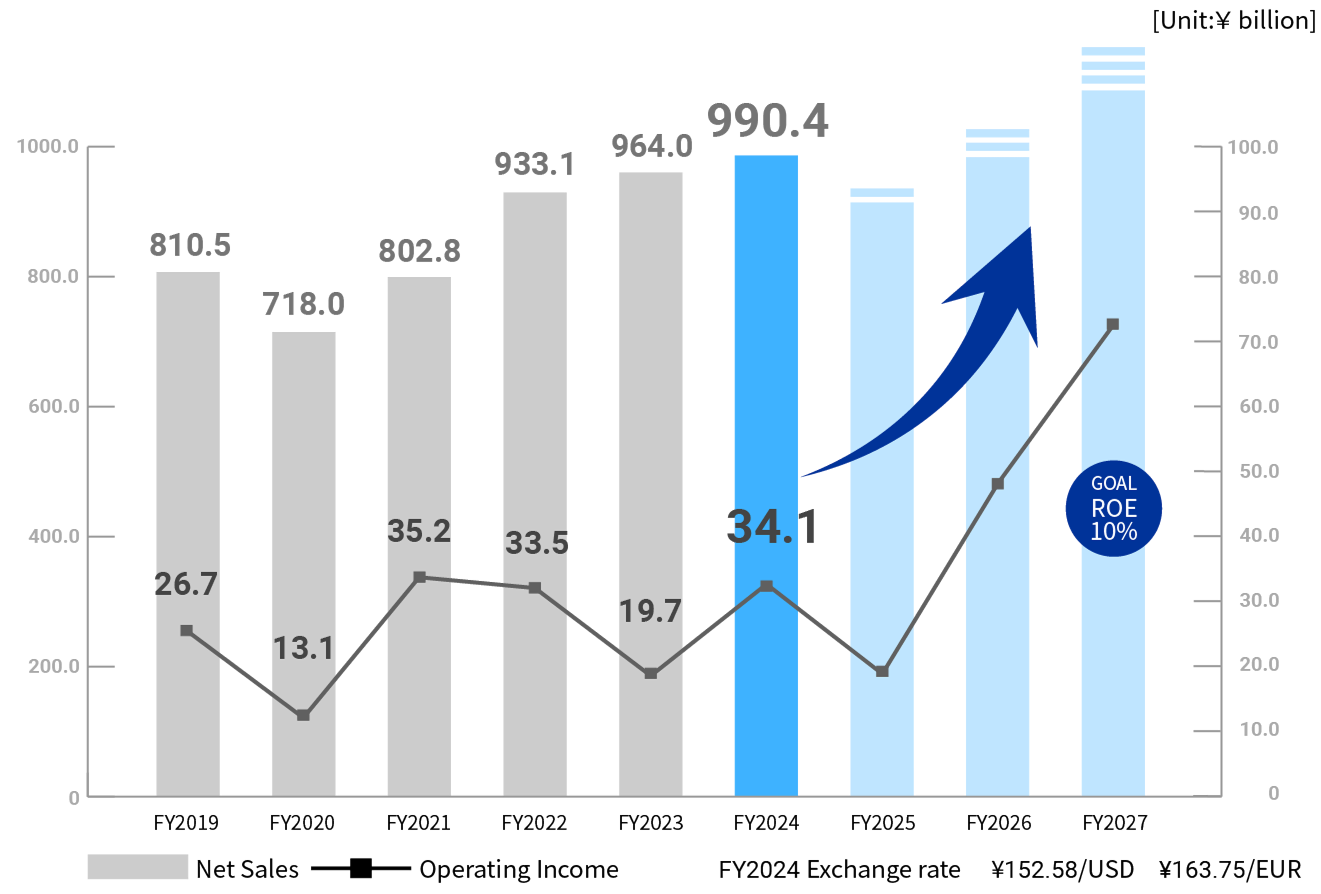

Trends in Net Sales and Operating Income

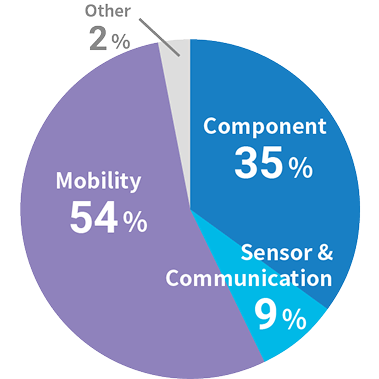

Business segment (FY2024)

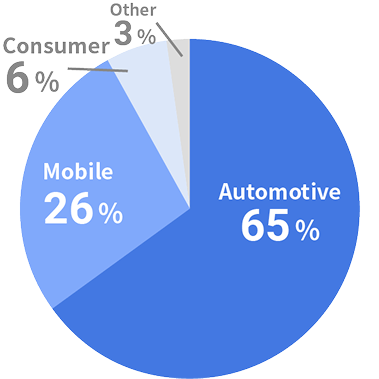

Market (FY2024)

OF ALPS ALPINE

Management Plan 2027

We will enhance our business profitability to achieve our management goals and

drive sustainable growth in corporate value.

Alps Alpine Mid-Term

Management Plan 2027

for the presentation materials.

Management Goals

Stock Price

Indicators

FY2026 PBR of 1.0or Higher

Capital

Efficiency

FY2027 ROE 10%

- Revenue:

- ¥1.075 trillion

- Operating Income:

- ¥71.0 billion

- Net Income:

- ¥45.0 billion

*Exchange Rate Assumption for FY2027

USD/JPY 145.00、

EUR/JPY 165.00 、CNY/JPY 20.00

Basic Policy

- Pursuit of High Added Value

-

Preparation of

the next main business -

Strengthening

the management base

Business Strategy

for Value Creation

Key Initiatives Through FY2027

Enhancing the Human

Capital Portfolio

Acquisition, Development,

and Deployment of

Talent for Value Creation

Fostering a Culture

That Enables Individuals to

Maximize Their Potential

for Realizing

a Sustainable Society

Medium-Term Goals

Through FY2030 (Partial)

Scope 1 & 2

GHG Emissions Reduction Plan

Scope 3

GHG Emissions Reduction Plan

Percentage of Electricity

Sourced from

Renewable Energy

- *Scope 1: Direct greenhouse gas emissions

from company-owned and controlled sources - *Scope 2: Indirect emissions from the

consumption of purchased electricity,

heat, or steam - *Scope 3: Indirect greenhouse gas emissions

across the entire supply chain,

excluding Scope 1 and 2.

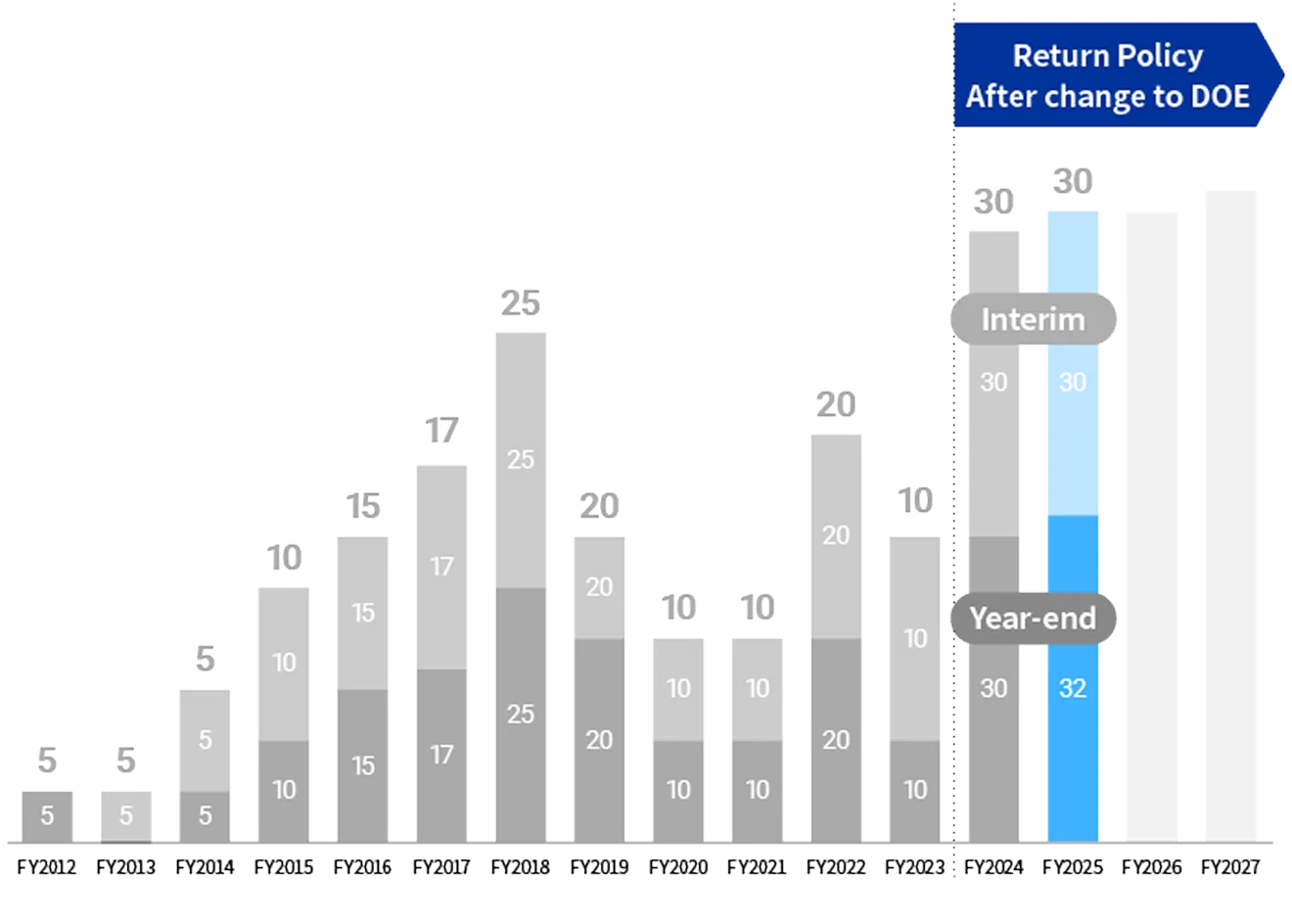

As an indicator of shareholder return, the Company will adopt DOE (dividend on equity ratio) to ensure stable and continuous returns to shareholders over the medium to long term, with a target of 3%. This policy started in FY2024, and will be in effect for four years in principle, and will be reviewed as necessary at the timing of Mid-Term Management Plan2030 starting in FY2028.

Dividend results for FY2024

Interim dividend 30.00yen

Year-end dividend 30.00yen

Dividend forecast for FY2025

Interim dividend 30.00yen (scheduled to be paid in late November 2025)

Year-end dividend 32.00yen (scheduled to be paid in late June 2026)